- Overview

- Our Focus

- Locations

- Contact Us

- Overview

- Our Culture

- Careers

- Jobs

Introduction: The client for this launch is a globally renowned medical device company, a provider of medical imaging, monitoring, biomanufacturing, and cell and gene therapy technologies. By offering intelligent devices, data analysis, software applications, and services, they achieve comprehensive precision medicine from disease diagnosis and treatment to monitoring. With over 100 years of history and more than 50,000 employees worldwide, the company is highly respected in the industry. (Hereinafter referred to as Company G). This project aims to address the expense management challenges faced by Company G's domestic-global operations, leveraging HELIOS’s solutions to enhance efficiency and compliance.

Project Challenges

Company G currently has over 5,000 employees in its domestic online segment, with numerous sales and engineers traveling across various cities and regions throughout China. They have been using a well-known overseas reimbursement system (hereinafter referred to as System C) for several years.

With the continuous evolution of China's invoice policies, the booming development of the medical and health business in China, and various data security challenges, several issues have inevitably arisen after years of use. These include the inability to achieve fine-grained budget management, incompatibility of financial invoice policies between domestic and overseas operations, timeliness of team operation and maintenance feedback, and the security protection of data transmission across borders.

Project Scope

In this project, the existing systems for invoice image management, business card management, travel platform, and budget were upgraded. HELIOS’s front-end advantageous function integration and expense control capabilities were connected with the back-end of the existing expense control platform of the foreign enterprise.

This integration aims to meet Global's unified financial management requirements while also partially addressing the need for enhanced domestic financial control experience.

Key Points of the Solution:

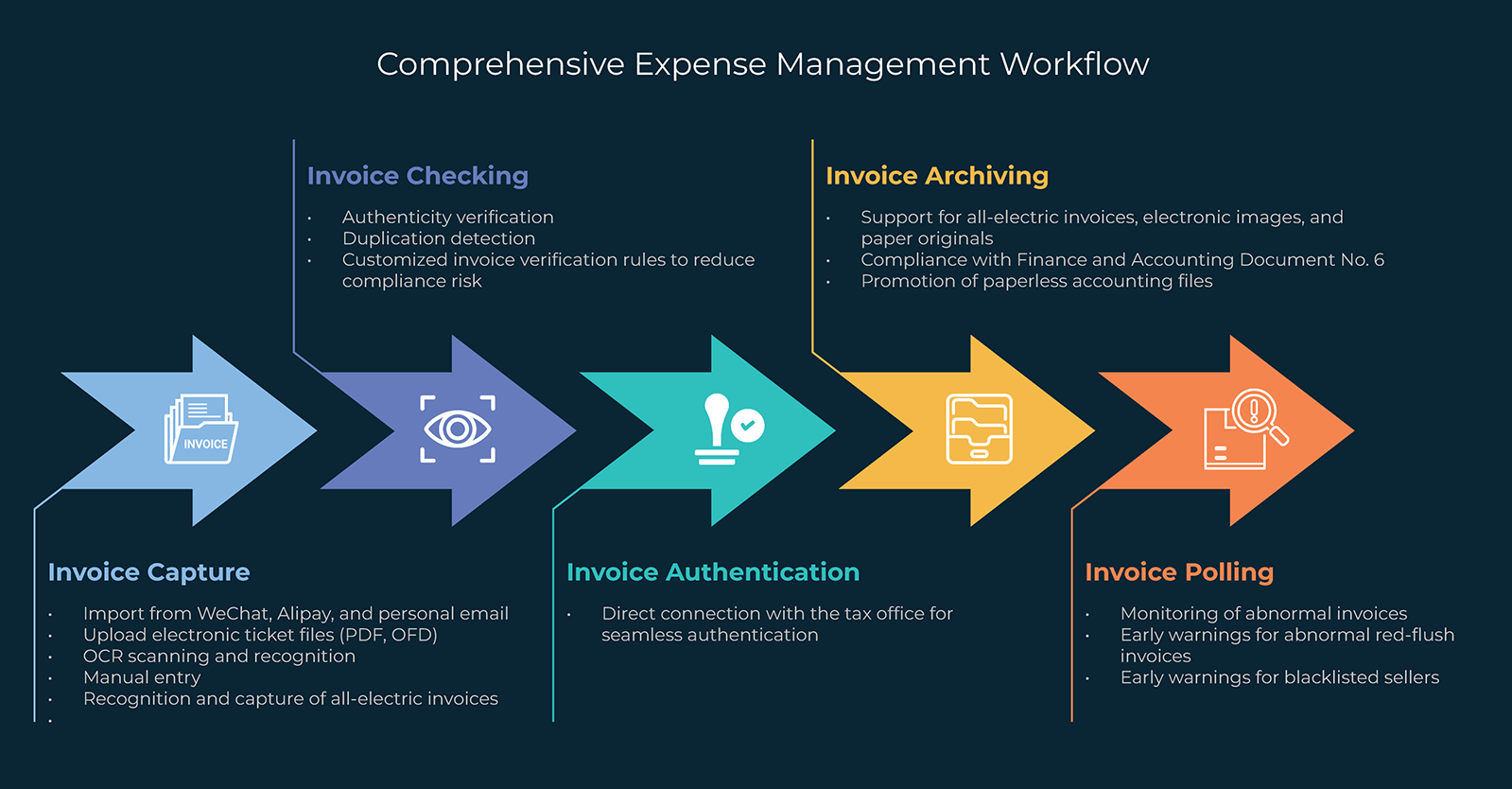

1. Invoice Management:

Challenges: In the current era of mixed paper and electronic invoices, invoice management is an essential part of expense control solutions both domestically and internationally. When Company G only used System C, issues with invoice collection and expense submission became quite apparent.

Firstly, the domestic environment requires the expense control system to support a wide range of invoices: digital invoices, VAT electronic special invoices/general invoices (electronic versions of VAT paper invoices), and paper invoices (including VAT invoices and various types of receipt recognition). The system must also accommodate the rapidly changing tax and financial policies.

Secondly, the expense control system needs to support the full lifecycle of invoices. It is not enough to only verify invoices at the collection stage; the system must also support regular and irregular polling after the invoice authentication and archiving stages to ensure there are no issues such as seller blacklisting or abnormal red-charging.

Without these functions, companies will inevitably face issues like "receiving digital invoices but lacking the system to collect, verify, and archive them," or "failing to detect invoice anomalies after they are accounted for, thus lowering the company's credit rating." This makes it impossible to perform cost control, analysis, and other digital upgrades based on these invoices. For large foreign enterprises that are traditionally well-managed and have high compliance requirements, upgrading is urgent.

Solution: The upgraded system supports digital invoices, VAT electronic special invoices/general invoices, and paper invoices. It also ensures compliance with changing tax and financial policies and supports the entire lifecycle of the invoice.

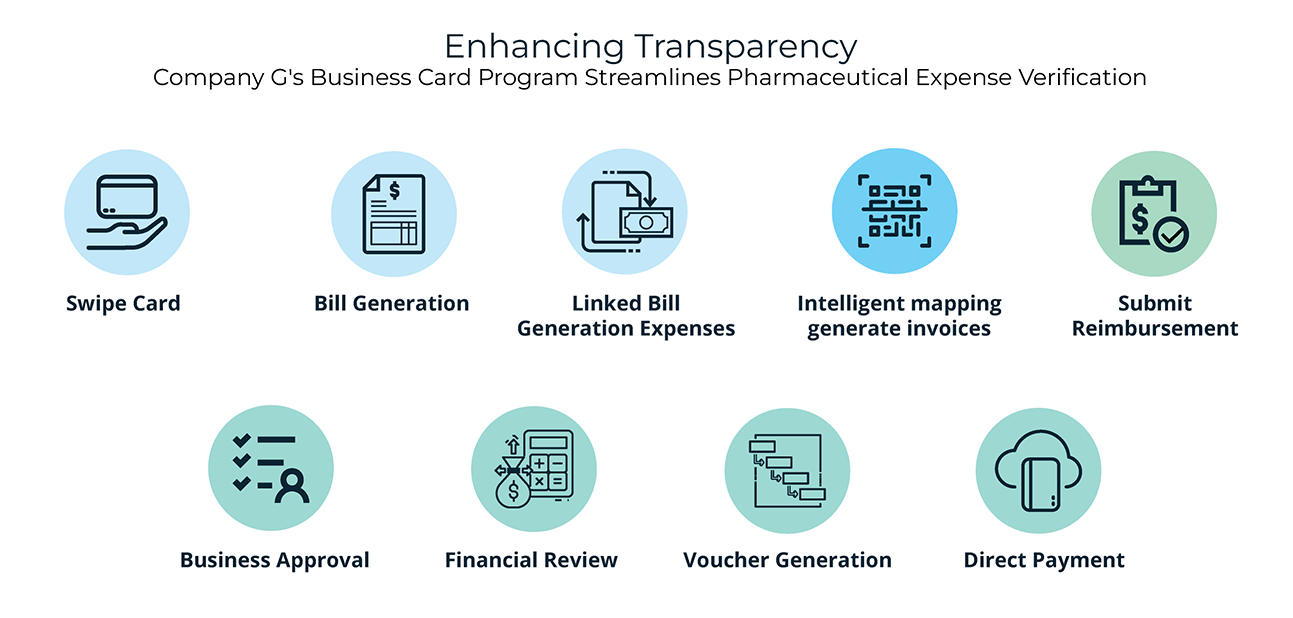

2. Business Credit Card Integration

Challenges: The pharmaceutical industry has always been a focus of anti-corruption efforts, and Company G has relatively high requirements for the authenticity of expenses.

Solution: The business card program supports the verification of employees' business transaction records, providing transparent information so that the company can promptly understand business expenditure data.

3. Vehicle Usage Integration

Challenges: The medical device company operates on a regional city-level management

system, where business personnel frequently incur intra-city transportation

expenses and use private cars for business purposes. In the past, the

management of ride-hailing services, taxis, and private cars was relatively

rough.

Solution: This project utilizes HELIOS's vehicle solution, which can clearly capture the details of trip expenses and enable unified invoicing and settlement for the enterprise. Additionally, the "private car for public use" function is activated, which calculates subsidies based on actual mileage and automatically generates expenses, ensuring accuracy and convenience.

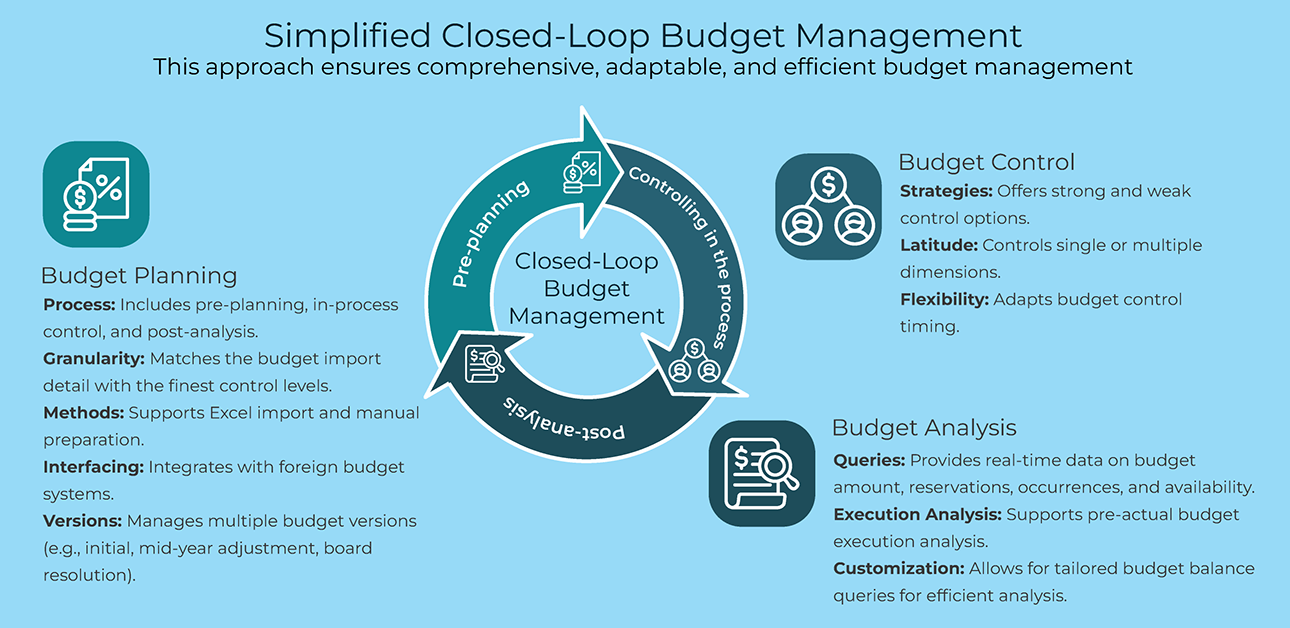

4. Budget Management

Challenges: Company G has a large-scale medical device business in China with a highly complex business structure. Under the division by business units, such as imaging (X-ray/ultrasound), anesthesia, etc., at various levels, there are regional units set up, such as [A BU - A1 Sub BU - East China - Zhejiang - Hangzhou - Group 1 - Section 3]. This six-level organizational structure requires flexible adjustments, analysis, and control of the budget, making it a key focus of this project upgrade.

Solution: HELIOS’s budget management functionality supports management at all stages: pre-planning, mid-term control, and post-analysis. The configuration dimensions support multi-level cost centers, multiple currencies, and adjustments, analysis, and control at the smallest granularity of the cost center, perfectly meeting the company's requirements.

5. System Integration

Challenges: In this project, a bold attempt is made to integrate with System C from a well-known global expense control vendor. The competition between domestic and overseas expense control systems has now turned into a collaboration.

Solution: HELIOS realizes the advantageous functions of "front-end entry of expenses and invoice information," "integration of business travel and business card expense information," and "expense budget verification"; The expenses generated by HELIOS are interfaced into the back-end System C to automatically generate documents, and employees submit expenses;

The original System C then handles approval, auditing, automatic accounting, and payment processing, maintaining its original state;

Finally, the payment status is fed back to the HELIOS system, forming a complete closed loop.

This solution is clear and complete, with stable interfaces. It is also the industry's first integration between domestic and overseas expense control systems, leveraging their respective strengths to provide clients with a comprehensive global expense control solution.

Conclusion: For Company G, this solution meets the need for upgraded granularity in expense control management for domestic finance, while also satisfying Global's demand for unified and strong control. It serves as a valuable reference for other foreign-funded enterprises.

For HELIOS, this represents a significant breakthrough, opening new perspectives and integration experiences for many enterprises using the C system, enabling more efficient and effective management.

Contact us for more information.